Here’s a Look at the October 2024 Denver Real Estate Market

October was a month of two halves: early October kicked off with enthusiasm, driven by a temporary drop in mortgage rates, while the latter part of the month slowed as rates spiked and economic uncertainty rose with the upcoming election.

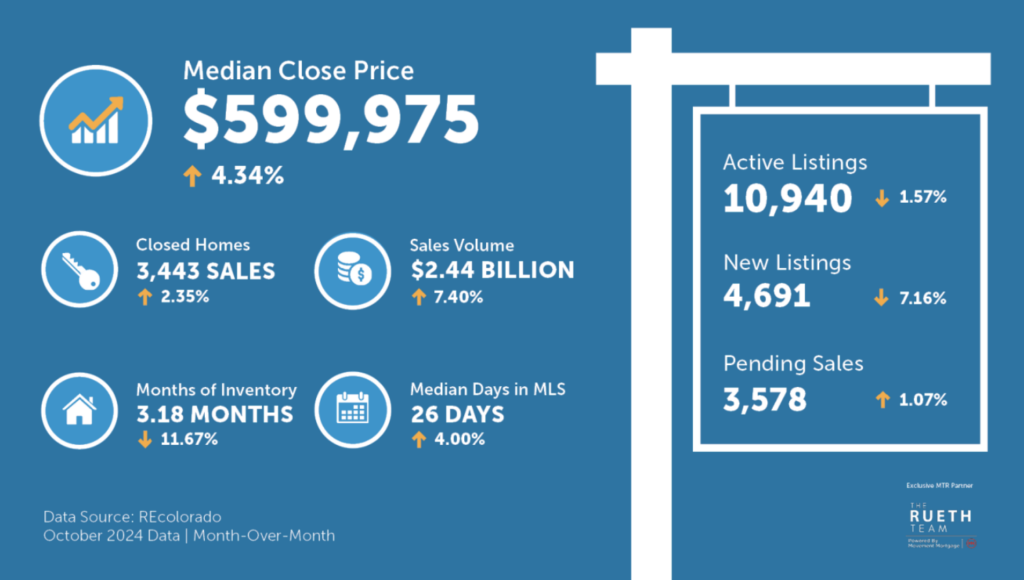

In early October, mortgage rates dipped to 6.1%, the lowest in 19 months. This rate drop was a green light for many buyers who had been holding off, leading to a jump in sales volume. Closed sales across the Denver Metro area rose by a modest but promising 2.35%, totaling 3,443 sales for the month. This surge kept our market active and made for a strong start to the month. Pending sales followed a similar upward trend, showing a flicker of resilience in what’s usually a slower season.

But things shifted quickly. By mid-October, mortgage rates had climbed back above 7%, a level we haven’t seen since 2023. That hike, paired with pre-election jitters, led to a more cautious approach from buyers. Many pressed pause, hoping to wait out the economic waters until we see some post-election clarity. This “wait-and-see” mentality isn’t uncommon as we move into an election year; in fact, it’s often followed by a resurgence in market activity once the political dust settles.

Inventory remains tight, with just over three months of supply available—a familiar story that continues to put pressure on both buyers and sellers. Limited inventory tends to keep our market competitive, even in periods of economic uncertainty. However, new listings dropped by 7.16% in October, likely a result of both election concerns and the seasonality we typically see this time of year. Sellers are understandably cautious, often preferring to wait until there’s more certainty before putting their homes on the market.

Looking forward, all eyes are on the Federal Reserve. Many experts are speculating that we may see a rate decrease in 2025, which could reignite buyer interest and provide sellers with a more robust market. Historically, the post-election period often brings a sense of stability, which in turn attracts more buyers and sellers into the fold. For now, though, we’re navigating a market where timing—and a touch of patience—will be key.

If you’re considering buying or selling in the current market, remember that fluctuations like these are part of the real estate rhythm. Whether you’re a buyer looking to capitalize on opportunities or a seller weighing your options, I’m here to help you make the best move for your goals. Reach out anytime—I’d love to chat about what these changes mean for you.