New Listings and Buyer Activity

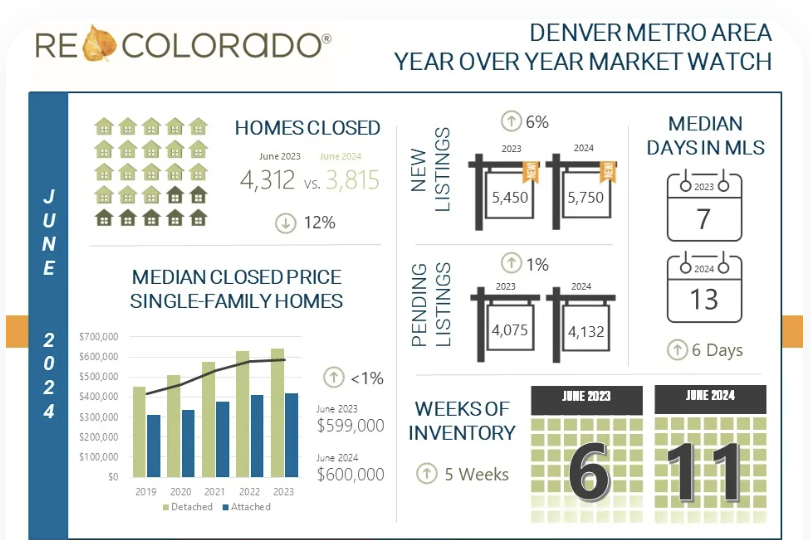

In June, the Denver housing market saw the addition of 5,750 new listings, marking a 6% increase compared to June 2023. Despite this year-over-year growth, the month-to-month comparison reveals a 15% decrease in new listings, breaking the trend of five consecutive months of increasing listings. This fluctuation suggests a shift in seller behavior, possibly influenced by market conditions or seasonal trends.

Buyer activity also showed signs of growth. A total of 4,132 contracts were executed on homes, reflecting a 1% increase from last year and a 4% increase from the previous month. However, homes remained on the market for a median of 13 days, which is 6 days longer than the same period last year. This extended market time could indicate a more deliberate approach by buyers, potentially due to rising interest rates or economic uncertainty.

Closed Sales and Median Prices

The number of closed homes in June was 12% lower than both June 2023 and the previous month. Despite this decline, the median closed price remained stable at $600,000, showing little movement compared to previous months. This stability in median prices amidst fluctuating sales volumes highlights a market where demand is still present, but buyers may be exercising caution.

As we wrap up the first half of 2024, REcolorado data points to a market gaining inventory as buyers remain cautious. From January to June, there was a 15% increase in new listings compared to the same period last year. However, the number of closings during this timeframe is 3% lower, as buyers navigate higher prices and interest rates.

Rental Market Dynamics

The rental market also experienced shifts in June. REcolorado MLS data shows that 310 properties were leased, 16% fewer than in June 2023. The median leased price of these properties was slightly higher, less than 1% more than last year. Additionally, 487 new rental listings were added to REcolorado MLS throughout the month, and by the end of June, there were 603 active rental properties available, a 15% increase from the previous month. This increase in rental inventory may provide more options for renters, potentially easing some of the competitive pressure seen in previous months.

Market Insights and Moving Forward

The Denver Metro Area housing market continues to be influenced by various factors, including interest rates, economic conditions, and seasonal trends. Buyers and sellers alike are adjusting their strategies in response to these conditions. The increase in new listings and the stable median prices suggest a resilient market, but the longer median days on market and the decrease in closed sales indicate that buyers are taking a more cautious approach.

For potential buyers, the increase in inventory could provide more choices and potentially better negotiating power. For sellers, understanding the current market dynamics and pricing their homes competitively will be crucial. Renters may find the growing rental inventory beneficial, offering more options and potentially stabilizing rental prices while investors might discover that their rents are not able to be increased despite rising maintenance costs.

As we move into the second half of 2024, monitoring these trends will be essential for making informed real estate decisions. Whether you’re buying, selling, or investing staying abreast of market conditions will help you navigate the ever-evolving Denver Metro Area housing market.