Competition Heats Up

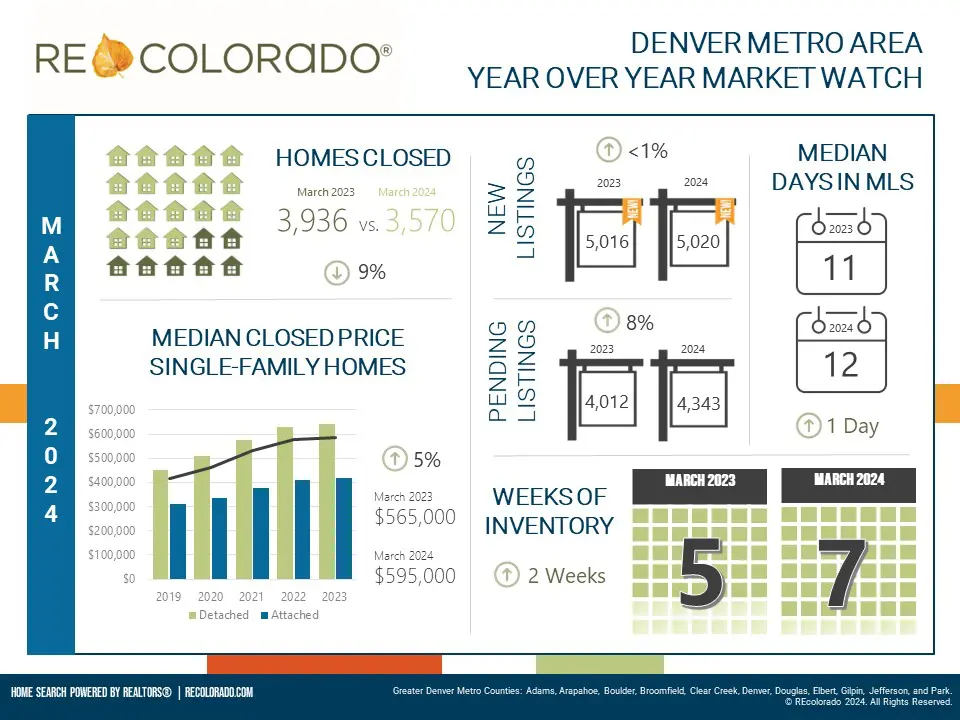

March 2024 Denver Area Market Update – Home buyers continued to enter the market at a rapid pace, with 4,343 new contracts signed in March. This represents an 8% increase compared to last year and a significant 33% jump from February. “Homes pending sale,” is a leading indicator of future closed sales and suggests a busy spring selling season ahead.

Buyers are acting fast as the housing market becomes more competitive. Homes spent a median of just 12 days on the market in March, going under contract nearly two weeks faster than in February. This highlights an increasing sense of urgency felt by buyers to secure a property before they are snatched up. Rising interest rates are creating pressure for buyers to act quickly.

Prices on the Rise

The strong demand is translating into higher prices for sellers. The closing price of homes sold in March was 5% higher than last year and 3% higher than in February. Homes priced above $1 million are in particularly high demand, contributing to the overall increase.

Strong Economy Fuels Buyer Demand

The strong demand is likely due to a combination of factors, including pent-up demand, the continued strength of the Denver Metro economy. Low unemployment and healthy job growth are putting more money in people’s pockets and boosting their confidence to buy a home.

Inventory Levels Rise, But Remain Tight

While buyer activity is surging, there is some positive news for those hoping to purchase a home. The number of new listings added to the market inched up slightly compared to last year and saw a more substantial 18% increase from February. This trend has continued year-to-date, with 11% more new listings coming onto the market compared to the same period in 2023.

This increase in new listings has helped boost overall inventory levels. At the end of March, there were 47% more active listings available compared to last year. However, with buyer demand so strong, these homes will likely continue to move off the market quickly.

Interest Rate Volatility Continues to be a Factor

Mortgage rates jumped to their highest reading since November as the timeline for highly anticipated interest rate cuts stretches deeper into 2024. The spike followed the release of new consumer price index inflation data for March, which came in slightly above economist expectations. The data raised concerns that the Federal Reserve would hold off on interest rate cuts that were forecasted in 2023. We expect a lot of volatility in the coming months and buyers to react to both rates rising and rates falling.

Rental Market Update

The Denver metro rental market saw a slight decrease in activity compared to last year. The number of properties leased using the REcolorado MLS system was down 16% in March compared to 2023. However, the median leased price held steady, increasing by 2% year-over-year. Additionally, the number of new rental listings added to the market showed some signs of slowing, with a 17% decrease compared to last March.

March 2024 Denver Area Market Update

Buying or Selling?

Give us a call. We’re happy to help you navigate the Denver metro housing market!